In our last article we emphasised working out revenue reliability in a downturn. Unfortunately, the ways we get comfortable about revenue reliability in a boom period don’t all work in a downturn.

Approaches From the Boom Don’t All Work

There are fine ways to understand revenue reliability during a decent period of economic growth. These include looking at length and security of contracts, customer churn, and trends in revenue per customer. Most companies also have a good handle on the mix of recurring, repeat and one-off business. We’ve even seen credible companies using net promoter score, God help them, to assess how reliable their revenues are from customers.

A downturn with rising nominal interest rates throws a lot of that out of the window. Downturns change customers’ own financial security, demand and willingness to pay changes. They change customers’ assessment of what is and isn’t a priority. Empirical observation of the past becomes less meaningful in this changed environment. So we need to pay more attention to the fundamentals of what makes revenue reliable.

Working Out Revenue Reliability – Fundamentals

The revenue reliability from a particular product or service to a particular customer is a function of three main things:

- The customer’s own likely performance and commercial viability

- Their propensity or requirement to spend on a product or service like yours in the coming months or years

- Their lock in or loyalty to you as a supplier

Going into a downturn, people typically have an OK idea about the latter two areas. But they have a poor idea about the first. So we’ll mainly cover that.

Understanding Customers’ Performance & Viability at Sector Level

The job of understanding customers’ prospects is very different depending on the nature and number of customers you have. It’s a different job if you have a long list of them versus a handful that dominate your sales. It’s also a very different job if your customers are diversified across sectors or versus dependence on 1 or 2 sectors.

If you have a long list then the good news is that you’re likely diversified within any sector. The bad news is that some sectors move downwards heavily in tandem during a downturn. The quickest and easiest way to look at this is to find a list of sector betas. These quantify how much the share price of the average company in that sector moves for every percent change in the overall market. This makes beta a decent measure of cyclicality.

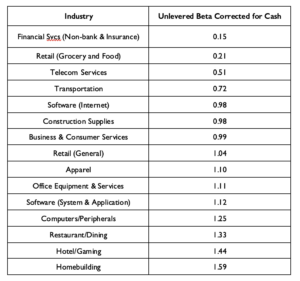

Here are some betas for a range of sectors.

The typical rule is that sectors selling capital goods suffer heavily in downturns and over perform in upturns. Same for those that rely on spend that can reasonably be delayed or downgraded. All these sectors typically also enter downturns sooner and exit them sooner.

Betas are based on historical market analysis and are no more than indicators of the future. Therefore the easy outline provided by betas needs to be coloured in with sector news. And it needs to be sector news from which you draw your own conclusions, not speculation by sector experts. Sector commentators make news, and in our view create a false confidence in unreliable but catchy and newsworthy speculation.

Understanding Customers’ Performance & Viability at Individual Company Level

If you’re reliant on a small number of customers then beta and sector news give a hint; but the specifics of each company are much more important to understand. There are obvious things to look at such as P&L, cash flow and indebtedness metrics, company news, and stock performance. But there there are a couple of more difficult sources that are worth examining if you’re heavily exposed to a customer. First, for large companies there are databases that show vulnerability to bond and loan renewals and other financial viability metrics. Restructuring consultancies use these to target clients, which shows their relevance. Second, you can talk to customers. Our experience of talking to customers about this sort of thing is that once you’ve established yourself as smart and trustworthy then most people talk straight and give you useful information. Of course you need to talk with the right, senior person who’s in a position to see the company’s broader performance. If they won’t talk to you, that’s good information about the strength your relationship.

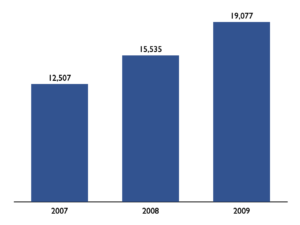

Even after you’ve done all this, you’d be reckless not to also assume some increase in natural attrition from insolvency. Because we’re entering a higher interest rate, lower growth environment following years of cheap and easy money. Here’s what happened to insolvencies during the last downturn.

Insolvencies 2007-9

This is an average across sectors, so you can assume that insolvencies in cyclical sectors will more than double.

Based on the previous downturn, it’s also wise to assume that restructurings will also more than double across the board in cyclical sectors. They could easily quadruple in more highly indebted customer groups. In each of these you’ll see your payments get delayed to the max by restructuring officers.

Understanding Propensity to Spend

Companies usually have a good idea about whether customers need to keep spending on their products and services. However, there’s a world of difference between spending now and spending later, especially when a big part of your customer base delays. Delay in spend is the killer in a downturn so the question to honestly answer is “Can my customer delay this spend by a few months without a meaningful cost to themselves?” If the answer is yes then you should assume that spend will be delayed.

Understanding Loyalty and Lock In

Customers shop around and even look at taking things in house when they’re under cost pressure and aren’t run off their feet with business. So understanding the combination of factors that create loyalty and lock in to your services is essential at a time like this. This combination of factors comprises contractual commitments, the nature of the product or service, switching cost, and satisfaction with your performance.

So, again, talking to customers is a good idea. When we speak to customers about the realities of switching cost and satisfaction, they’re honest with us, and there are often some rude awakenings for companies that prided themselves on those strong net promoter scores.

Taking Action

With good information on customer vulnerability most of the actions are obvious. Focusing sales, retention and marketing efforts on reliable customer groups. Addressing any hint of underperformance to customers with low switching costs. Focus debtor attention on more vulnerable groups. And work on the basics of lock in such as breadth of services, breadth and depth of relationships, performance, and incentives such as basket pricing.

Sports teams need to adjust to what’s possible on a windswept rainy Saturday in January compared to a balmy day in May. In the same way, we need to reassess what’s realistic from our customers during this creative destruction stage of the cycle, and know what we can rely on.

Sources

https://pages.stern.nyu.edu/~adamodar/New_Home_Page/data.html

http://www.insolvencydirect.bis.gov.uk