One golden rule in the gym for anyone looking to get strong is Never Skip Leg Day.

If you’ve ever noticed a gym bro in the summer showing off his manscaped guns and torso, balancing precariously on skinny little legs, then you know why this rule exists. Lots of gym bros just care about arms and torso days because the results are visible and fairly immediate. With legs, well you can go months without a visible result, and those legs are hidden in trousers well below mirror height. Oh and leg day is hard.

Arm Day & Leg Day for Businesses

Here’s some business equivalents of arm day and leg day, for those of us who spend our time caring about businesses being successful.

The arm day list is a lot about sales and service, and compared to the leg day list has those immediate and visible effects that we all love. The leg day list is much more about product, process, relationships and taking time to build people’s skills. Anyone who has spent hours and hours training someone else to do something that they could themselves in minutes, knows about the payback time of leg day. And some of the things on the list can take years to bear fruit. To cap it all, the longer incubation time for leg day activities also means it’s hard to know what action created which result.

Leg Day Improves Returns

But let’s just look at the top one from the leg day list to see why we should care a lot about it. Business researchers have shown consistently and for years, across sectors, countries and business sizes, that companies spending more on R&D enjoy faster profit growth than their peers. This works whether you compare consistent high spenders to consistent low spending peers, or if you look at companies that increase spend versus companies that don’t. There’s a lag, often as long as two years, but the effect is real, even during a recession[1].

Leg Day Lowers Risk

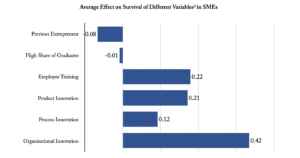

Also, this investment isn’t a high beta roll of the dice that increases risk in line with increasing average returns. Product and process development typically reduces risk, with firms that innovate more here having increased chances of survival over a business cycle and in times of financial crisis. In fact, the other big factor in survival is another leg day activity: staff training. In contrast, the classic factors of backing seasoned entrepreneurs with smart employees have a marginal to negative effect on survival.

Why Everyone Skips Leg Day & Why You Shouldn’t

The sobering thing about these findings is that virtually everyone skips business leg day most of the time. In the world of business strategy and pre investment due diligence, the commercial focus and demand for services is overwhelmingly on arm day activities. Try a search on commercial due diligence checklists, and I guarantee the closest you get to leg day is assessing customer satisfaction with the current product. Look at a hundred board packs, and barely a handful will have even one KPI about any leg day activity. Ask your investors if they’re happy to take a major 2 year hit on profit for you to get the product to the next level, quadruple your investment in thought leadership, or triple the training budget, and see what reaction you get.

This isn’t to say arm day isn’t essential. But it’s getting plenty of attention already. So please take the lesson from the smart gym goers and start spending more time on leg day. You’ll thank me later.

Footnotes:

[1] It’s unlikely that the causation was reversed and higher growth caused higher R&D in these studies because they showed an increase in R&D followed by an increase in growth; however it is possible that better management teams both invest more in R&D and are better at getting more growth anyway. Seems like good management teams don’t skip leg day.

[2] Low R&D intensity means R&D spend less than 1% of revenue, high means greater than 10%

[3] Contribution of selected factors in multivariate analysis of surviving versus non surviving firms, non selected factors were more intangible (e.g. interest in certain subjects) or incomplete (e.g. only certain entrepreneur age brackets presented)

Sources: